Fraud and Identity Theft By the Numbers

Who is at Risk of Fraud?

The Federal Trade Commission (FTC) releases an annual fraud report through the Consumer Sentinel Network. This report is filled with fraud facts and statistics that help consumers understand the current trends. We’ve gone ahead and identified several key stats, as well as fraud facts in VA, MD and DC.

- In 2023, the FTC reported $10.0 billion in losses as a result of fraudulent activity — an increase of $1.2 billion over 2022

- There were approximately 101,427 people who suffered credit card fraud which meant that a credit card account was opened utilizing their information

- 48.0% of all reports to the FTC were to report fraud, followed by identity theft at 19.0%

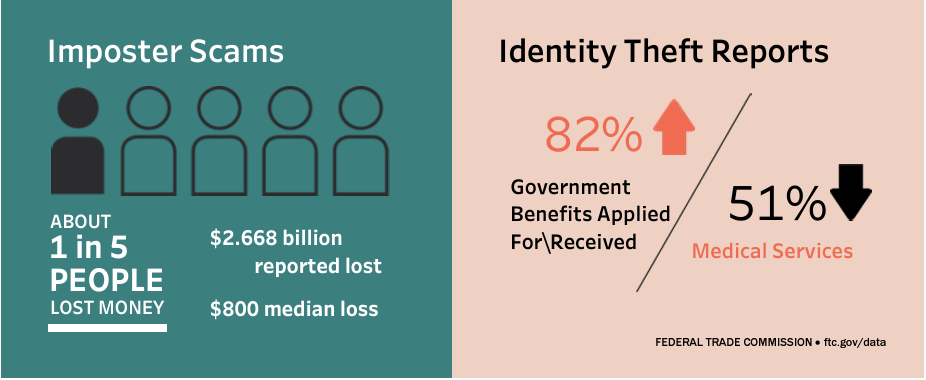

- Nearly 1 in 5 people reported a financial loss due to an imposter scam

- 272,971 adults ages 30-39 and 168,731 adults ages 20-29 were victims of identity theft

Percentages are based on the total number of Consumer Sentinel Network reports by calendar year. These figures exclude “Do Not Call” registry complaints.

Source: Federal Trade Commission, Consumer Sentinel Network.

Due to the nature of the internet and our digital footprint, anyone who uses the internet to input sensitive information is at risk of becoming a victim of identity theft and fraud.

In terms of demographics, the tables aren’t turned quite the way you think they would be. Interestingly enough, the FTC revealed that millennials are actually more likely to be a victim of fraud than the elderly.

These fraud facts showed that 44% of adults age 20-29 who have reported fraud, end up losing money in a fraud case, compared to only 25% seniors. However, when seniors lose money to fraud, they have a much higher loss rate than young adults.

Fraud Incidences in VA, MD and DC

According to the Federal Trade Commission’s report in 2023, our region ranked in the top 10 in terms of fraud report density compared by population.

| State | Complaint per 100,000 population | Number of Complaints | Rank |

| D.C. | 1,885 | 12,877 | 1 |

| Maryland | 1,372 | 84,353 | 6 |

| Virginia | 1,139 | 97, 746 | 10 |

Fraud Facts in Maryland in 2023

- 18% of fraud reported involved identity theft and 15% of fraud reported involved imposter scams

- Credit Card fraud was the #1 method of identity theft

- There were 18,327 reports of identity theft in total

- Maryland suffered $164.3M in total fraud losses

Fraud Facts in DC in 2023

- 13% of fraud involved imposter scams

- 45% of identity theft was a result of credit card fraud

- There were 3,268 reports of identity theft in total

- DC suffered $13.3M in total fraud losses

Fraud Facts in VA in 2023

- 16% of all fraud was related to imposter scams

- 40% of identity theft was a result of credit card fraud

- There were 19,211 reports of identity theft in total

- Virginia suffered $205.2M in total fraud losses